All Categories

Featured

Table of Contents

Choosing to invest in the realty market, supplies, or other basic sorts of assets is prudent. When deciding whether you ought to spend in accredited financier chances, you should balance the trade-off you make between higher-reward possible with the lack of coverage needs or regulatory transparency. It needs to be stated that exclusive placements entail greater degrees of threat and can fairly frequently stand for illiquid financial investments.

Especially, nothing here should be analyzed to state or indicate that previous results are an indicator of future efficiency nor ought to it be translated that FINRA, the SEC or any type of other safeties regulatory authority authorizes of any one of these safeties. Furthermore, when assessing exclusive positionings from sponsors or companies using them to certified financiers, they can provide no warranties revealed or indicated as to precision, completeness, or results obtained from any type of details supplied in their discussions or presentations.

The company needs to provide information to you through a paper called the Personal Placement Memorandum (PPM) that uses a much more thorough explanation of expenditures and risks connected with taking part in the investment. Rate of interests in these bargains are just offered to individuals that qualify as Accredited Investors under the Stocks Act, and a as specified in Section 2(a)( 51 )(A) under the Company Act or an eligible staff member of the administration company.

There will not be any kind of public market for the Rate of interests.

Back in the 1990s and early 2000s, hedge funds were recognized for their market-beating efficiencies. Generally, the supervisor of an investment fund will set aside a part of their offered properties for a hedged wager.

How do I exit my Accredited Investor Real Estate Income Opportunities investment?

A fund manager for an intermittent industry may devote a section of the assets to supplies in a non-cyclical field to offset the losses in case the economic climate tanks. Some hedge fund managers use riskier strategies like utilizing borrowed money to purchase even more of a possession simply to increase their potential returns.

Comparable to mutual funds, hedge funds are skillfully managed by profession financiers. Hedge funds can apply to different investments like shorts, choices, and derivatives - Accredited Investor Real Estate Income Opportunities.

Why should I consider investing in Accredited Investor Real Estate Crowdfunding?

You might pick one whose investment philosophy straightens with yours. Do keep in mind that these hedge fund cash supervisors do not come low-cost. Hedge funds typically charge a cost of 1% to 2% of the properties, in enhancement to 20% of the revenues which functions as a "efficiency charge".

High-yield financial investments attract numerous financiers for their capital. You can purchase a possession and obtain rewarded for keeping it. Approved financiers have more possibilities than retail investors with high-yield investments and beyond. A higher range gives accredited financiers the opportunity to obtain greater returns than retail capitalists. Recognized investors are not your regular capitalists.

Commercial Real Estate For Accredited Investors

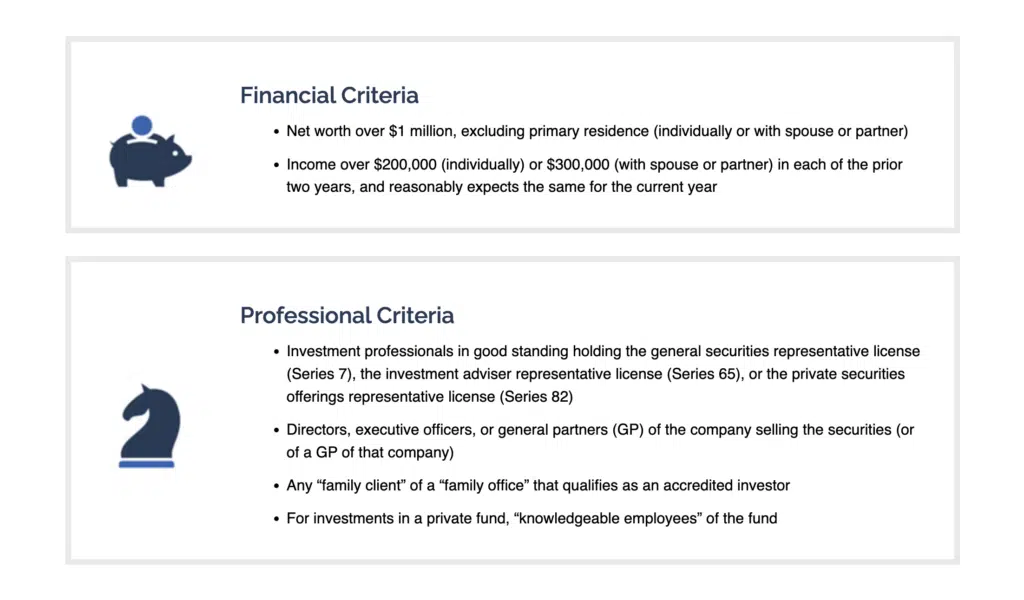

You need to accomplish a minimum of among the complying with criteria to become a recognized capitalist: You should have over $1 million total assets, omitting your primary residence. Business entities count as recognized financiers if they have more than $5 million in assets under management. You need to have a yearly revenue that exceeds $200,000/ yr ($300,000/ year for companions filing with each other) You need to be a registered financial investment expert or broker.

Consequently, accredited financiers have extra experience and cash to spread out throughout properties. Recognized financiers can seek a more comprehensive variety of properties, but extra options do not ensure greater returns. The majority of investors underperform the market, consisting of certified capitalists. In spite of the higher status, accredited financiers can make substantial mistakes and do not have access to insider information.

Crowdfunding gives recognized investors a passive function. Property investing can help replace your revenue or lead to a quicker retired life. Additionally, capitalists can build equity via favorable cash money flow and property gratitude. Nonetheless, property residential or commercial properties require significant maintenance, and a great deal can go incorrect if you do not have the appropriate team.

What should I know before investing in Accredited Investor Property Portfolios?

Actual estate distributes merge money from certified financiers to get buildings straightened with established goals. Accredited investors pool their cash together to finance purchases and residential property development.

Realty investment company have to disperse 90% of their gross income to investors as rewards. You can purchase and market REITs on the stock exchange, making them extra liquid than the majority of investments. REITs permit capitalists to branch out rapidly throughout numerous home courses with extremely little resources. While REITs also transform you right into a passive financier, you get more control over necessary choices if you join a genuine estate syndicate.

How do I choose the right Exclusive Real Estate Crowdfunding Platforms For Accredited Investors for me?

The owner can choose to carry out the exchangeable option or to sell before the conversion happens. Exchangeable bonds enable investors to get bonds that can end up being supplies in the future. Capitalists will profit if the supply price increases considering that convertible financial investments offer them extra eye-catching access points. Nonetheless, if the stock rolls, capitalists can opt against the conversion and secure their finances.

Latest Posts

Unpaid Taxes On Houses

Property Sold At Tax Sale

Government Real Estate Tax Sales